Tax Advisor Philippines - Jobs and Salary, How to find a job

What is the salary of - Tax Advisor Philippines?

How to find a job - Tax Advisor Philippines?

What are the typical job requirements for this occupation?

Tax Advisor Philippines - What are the typical requirements or qualifications in job postings?

The most common places to find a job are: Manila (capital city), Quezon City, Budta, Davao City, Malinao, Cebu City, General Santos, Taguig

Number of persons of Indian origin in Philippines - 150000

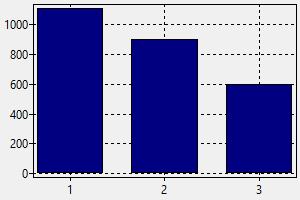

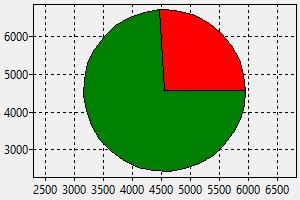

Salary for the job: Tax Advisor Philippines - USD 735 (60297 INR)

Average salary Philippines - USD 381 (31242 INR)

Wages are paid in local currency: PHP (Philippine pesos)

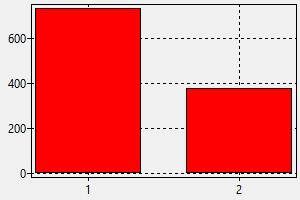

The impact of the work experience on the salary:

Experienced: + 51%

Mid-Career: + 23%

Entry-Level: - 19%

Employee benefits

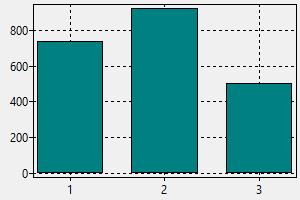

Retirement plan: Not common

Health insurance: Yes

Internal and external training courses: From time to time

Career development plan for the employees: Very common

Typical job requirements

Education level: University degree

Certification: May be required

IT literate: Necessary

Probation period: No

Official language: English, Filipino, Sign language

Knowledge of foreign languages: Necessary

Driver's licence: Necessary

Work experience: Impact on the salary - High

Job type:

Full Time Job

Part Time Job

Contract employment

Online Job

Telecommuting (Work from home)

Freelance Job

Self-employment

Industry: banking and finance jobs

Working time and paid leave

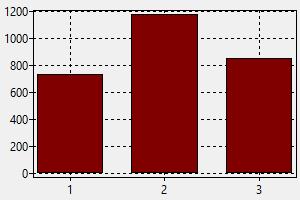

Working week: Monday - Friday

Working hours per week: 45 (including lunch break)

Overtime working hours: Not frequently

Paid vacation days: 5 (The contract may be different)

Paid public holidays: 11

Lunch break: Yes

Lunch break duration: 1 hour

Flexible working hours: Yes

Tips for finding a job as a foreigner

Is working permit / working visa required? Required

Required level of proficiency in the local language: Full professional level

Unemployment rate Philippines - 10.0%

Retirement age Philippines - 60-65

Companies in Philippines, with the highest published employment and wages for this occupation - tax advisor, are accounting firms and consulting companies.

→ Check out salaries for other occupations - Philippines

Similar jobs:

→ Account Manager

→ Account Manager

→ Auditor

→ Auditor

→ Financial Advisor

→ Financial Advisor

→ Sales Administrator

→ Sales Administrator

→ Risk Analyst

→ Risk Analyst