Tax Advisor Germany - Jobs and Salary, How to find a job

What is the salary of - Tax Advisor Germany?

How to find a job - Tax Advisor Germany?

What are the typical job requirements for this occupation?

Tax Advisor Germany - What are the typical requirements or qualifications in job postings?

The most common places to find a job are: Berlin (capital city), Munich, Hamburg, Stuttgart, Hanover, Cologne, Frankfurt am Main, Essen, Dortmund, Dusseldorf, Bremen, Dresden

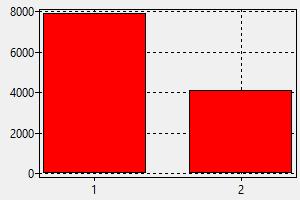

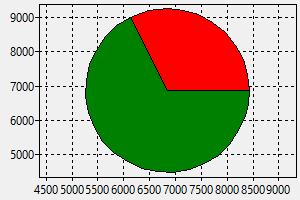

Salary for the job: Tax Advisor Germany - USD 11638

Net salary (Salary after payroll taxes and benefits) - USD 7864

Average salary Germany - USD 6030

Wages are paid in local currency: EUR (Euros)

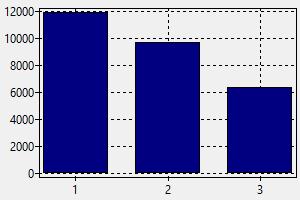

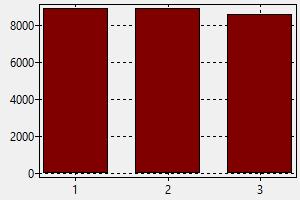

The impact of the work experience on the salary:

Experienced: + 51%

Mid-Career: + 23%

Entry-Level: - 19%

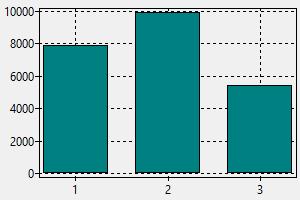

Employee benefits

Retirement plan: Not common

Health insurance: Yes

Internal and external training courses: From time to time

Career development plan for the employees: Very common

Typical job requirements

Education level: University degree

Certification: May be required

IT literate: Necessary

Probation period: No

Official language: German

Knowledge of foreign languages: Necessary

Driver's licence: Necessary

Work experience: Impact on the salary - High

Job type:

Full Time Job

Part Time Job

Contract employment

Online Job

Telecommuting (Work from home)

Freelance Job

Self-employment

Industry: banking and finance jobs

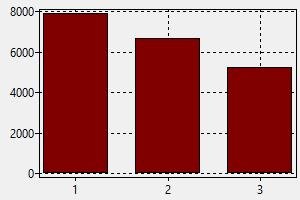

Working time and paid leave

Working week: Monday - Friday

Working hours per week: 40

Overtime working hours: Not frequently

Paid vacation days: 20 (The contract may be different)

Paid public holidays: 9

Lunch break: Yes

Lunch break duration: 30 minutes

Flexible working hours: Yes

Tips for finding a job as a foreigner

Is working permit / working visa required? EU nationals generally do not require work permits to work within the EU, whereas nationals from other countries typically need to obtain work permits.

Required level of proficiency in the local language: Full professional level

Unemployment rate Germany - 4.4%

Retirement age Germany - 65.83

Companies in Germany, with the highest published employment and wages for this occupation - tax advisor, are accounting firms and consulting companies.

→ Check out salaries for other occupations - Germany

Similar jobs:

→ Account Manager

→ Account Manager

→ Auditor

→ Auditor

→ Financial Advisor

→ Financial Advisor

→ Sales Administrator

→ Sales Administrator

→ Risk Analyst

→ Risk Analyst